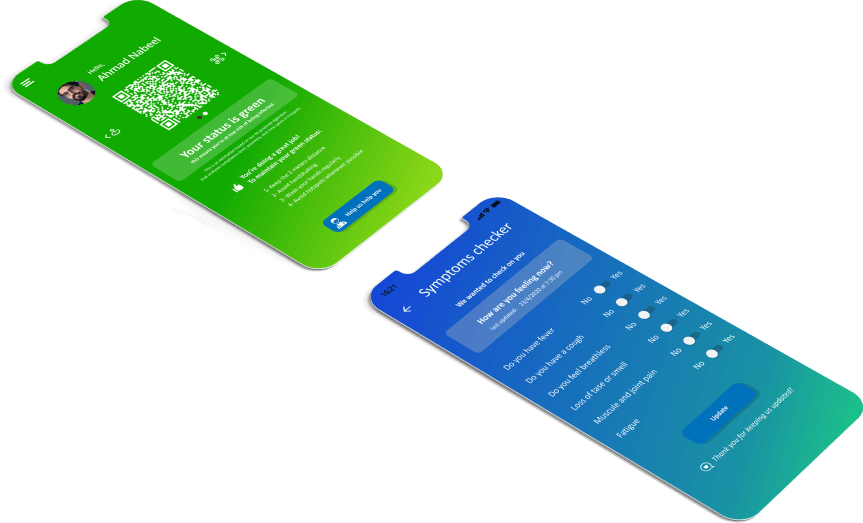

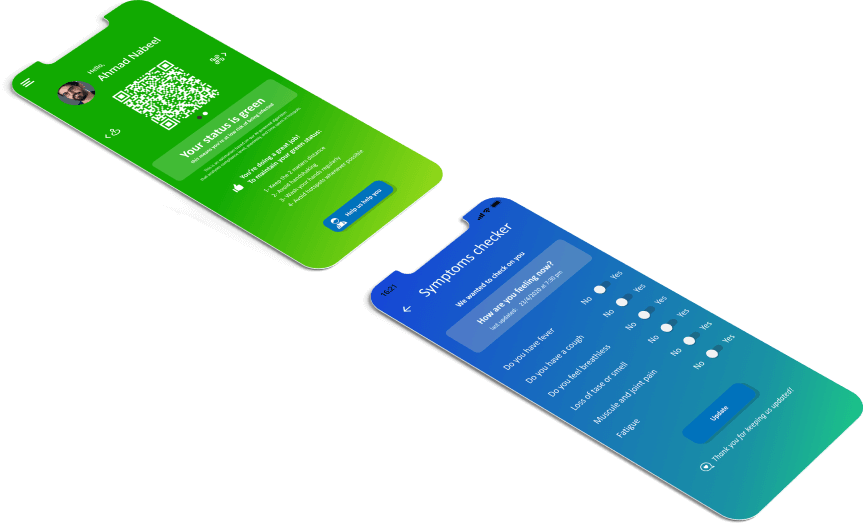

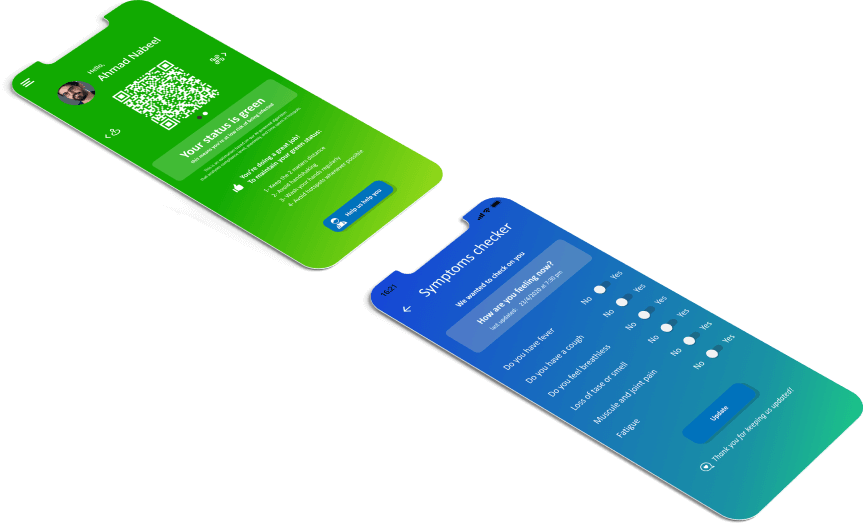

A Streamlined Investment Platform for Real Estate Loans

We built a secure and user-friendly platform for Mid Atlantic Secured Income Fund to simplify investor onboarding and investment management. The system supports both new and existing investors, guiding them step-by-step from registration to signed agreements.

Duration: Jul 2024 - Present | Industry: • Real Estate • Business

Get Started