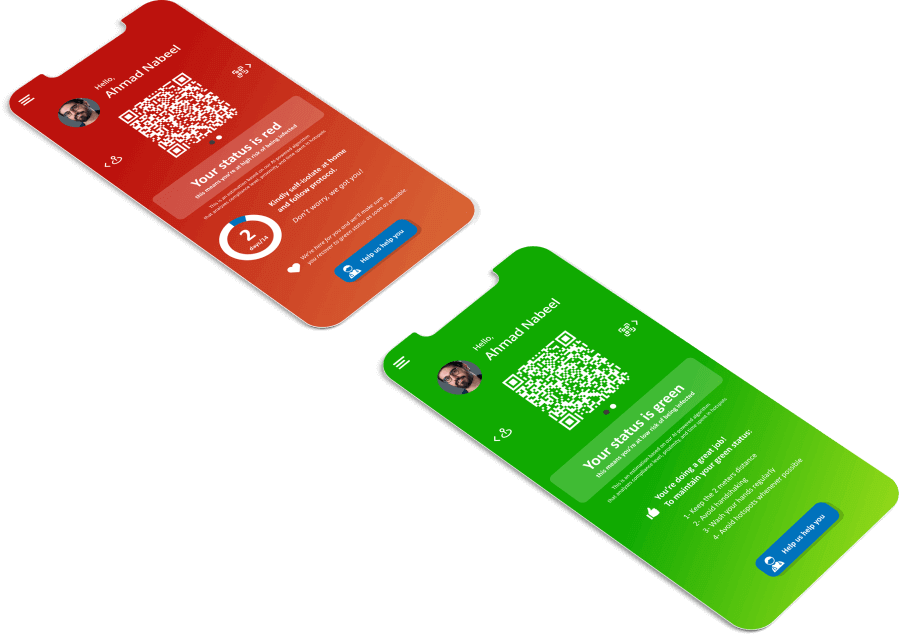

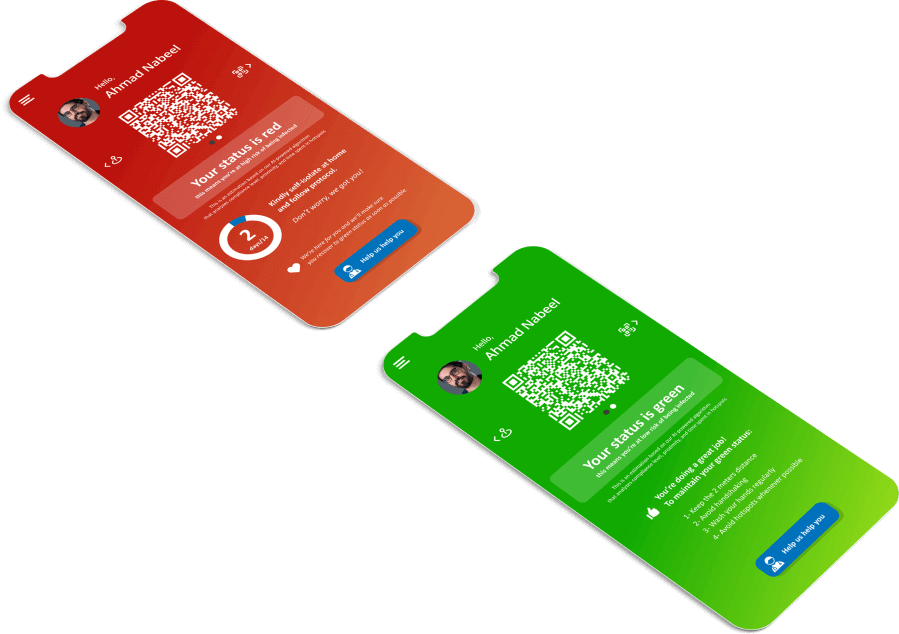

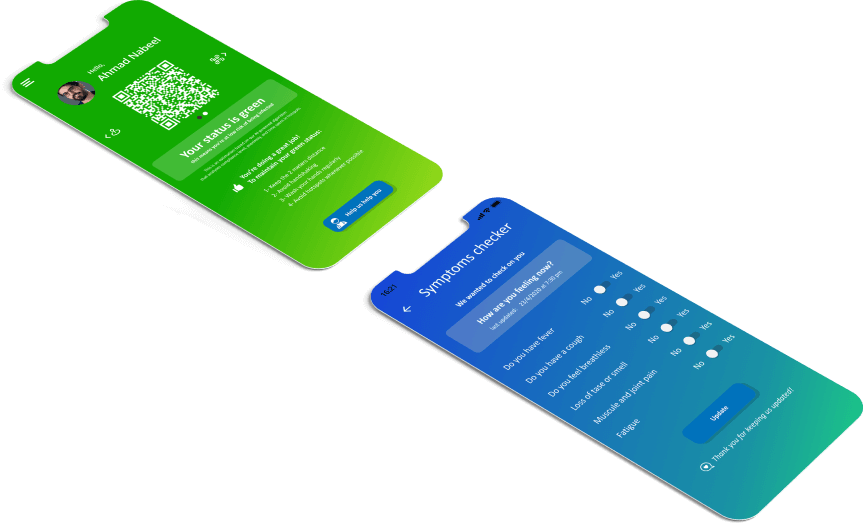

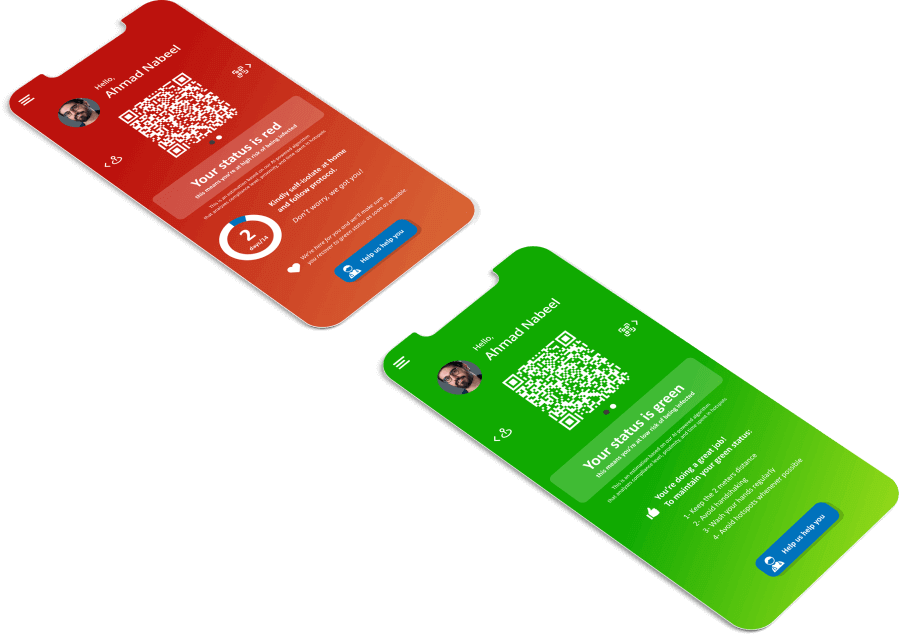

Mobile buyer dashboard displaying credit status, plan breakdowns, and purchases

Easy access to credit, purchases, and repayment visibility.

The Buyer Portal is a mobile-friendly dashboard where small business owners discover plans, make the required deposit, and shop up to their approved credit limit. The portal presents a clear breakdown of any selected plan total amount, upfront deposit (e.g., 10%), repayment schedule (daily/weekly/etc.), and the per-period repayment amount so buyers understand obligations before they confirm. Cart logic enforces the plan limit in real time and prevents checkout if the cumulative product total would exceed the credit line.

Buyers can manage orders, view transaction history, and download PDF invoices. The portal also shows a live wallet balance (outstanding vs paid), upcoming due dates, and a simple chart of repayment progress. OTP-backed login and step-up authentication protect accounts and reduce fraud, while in-app messaging informs buyers of approvals, denials, and agent visits.